Chinese soybean importers are turning to more competitively priced Brazilian soybeans as trade tensions with the United States escalate ahead of President-elect Donald Trump's return to office. With fears of new import tariffs on U.S. goods, Chinese buyers have already secured the majority of their soybean imports from Brazil for the first quarter of 2025.

Key Insights:

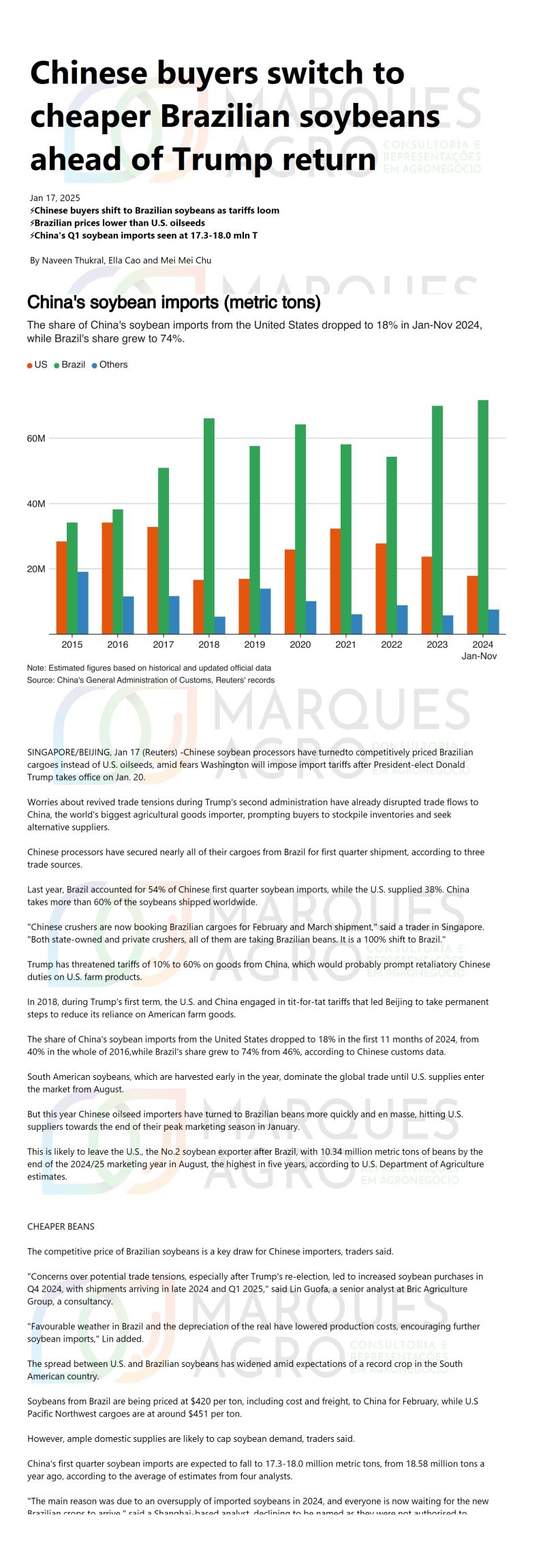

- Market Shift: In 2024, the U.S. share of China's soybean imports dropped to 18% from 40% in 2016, while Brazil's share surged to 74% from 46%.

- Price Advantage: Brazilian soybeans are currently priced at $420/ton (C&F to China for February), significantly lower than U.S. soybeans at $451/ton.

- Projected Imports: China's soybean imports in Q1 2025 are expected to range between 17.3 and 18.0 million metric tons, slightly lower than 18.58 million tons imported during the same period last year.

Trade Tensions Resurface

Concerns of increased tariffs on Chinese goods by the U.S., ranging from 10% to 60%, are pushing Chinese importers to diversify their sourcing strategies. In 2018, similar tensions during Trump’s first term resulted in tit-for-tat tariffs, permanently reducing China's reliance on American soybeans.“Chinese crushers are now booking Brazilian cargoes for February and March shipment. It is a 100% shift to Brazil,” said a trader in Singapore. Both state-owned and private crushers are taking Brazilian beans exclusively.

Favorable Conditions for Brazil

Brazil's competitive pricing stems from favorable weather, a depreciated real, and overproduction in 2024. Combined with the early harvest of Brazilian soybeans, the country has gained a stronghold in global soybean exports, dominating trade from August onward.

Impact on the U.S.

The shift to Brazilian soybeans has left U.S. soybean suppliers struggling to regain their market share in China. Despite competitive pricing from the Pacific Northwest, Chinese buyers remain hesitant to engage due to anticipated tariffs.

Outlook

With the U.S. poised to impose stricter trade policies, Chinese buyers are expected to maintain their reliance on Brazilian soybeans. Analysts predict this trend will continue to shape global soybean trade dynamics throughout 2025.